Employees who participate in 401(k) plans assume responsibility for their retirement income by contributing part of their salary and, in many instances, by directing their own investments.Īn Employee Stock Ownership Plan (ESOP) is a form of defined contribution plan in which the investments are primarily in employer stock.Ī Cash Balance Plan is a defined benefit plan that defines the benefit in terms that are more characteristic of a defined contribution plan. An employer must advise employees of any limits that may apply.

There is a dollar limit on the amount an employee may elect to defer each year. Sometimes the employer may match these contributions. Employees can elect to defer receiving a portion of their salary which is instead contributed on their behalf, before taxes, to the 401(k) plan. A profit sharing plan or stock bonus plan may include a 401(k) plan.Ī 401(k) Plan is a defined contribution plan that is a cash or deferred arrangement. The plan contains a formula for allocating to each participant a portion of each annual contribution. If an employer had a salary reduction SEP, the employer may continue to allow salary reduction contributions to the plan.Ī Profit Sharing Plan or Stock Bonus Plan is a defined contribution plan under which the plan may provide, or the employer may determine, annually, how much will be contributed to the plan (out of profits or otherwise). However, employers are permitted to establish SIMPLE IRA plans with salary reduction contributions. Employers may no longer set up Salary Reduction SEPs. Under a SEP, an employee must set up an IRA to accept the employer's contributions. SEPs are subject to minimal reporting and disclosure requirements. A SEP allows employees to make contributions on a tax-favored basis to individual retirement accounts (IRAs) owned by the employees. Examples of defined contribution plans include 401(k) plans, 403(b) plans, employee stock ownership plans, and profit-sharing plans.Ī Simplified Employee Pension Plan (SEP) is a relatively uncomplicated retirement savings vehicle. The value of the account will fluctuate due to the changes in the value of the investments.

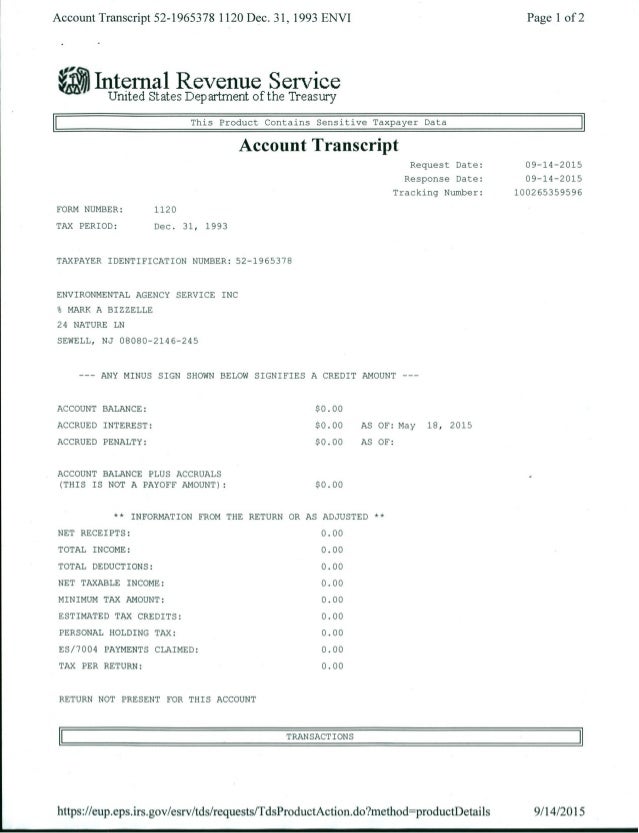

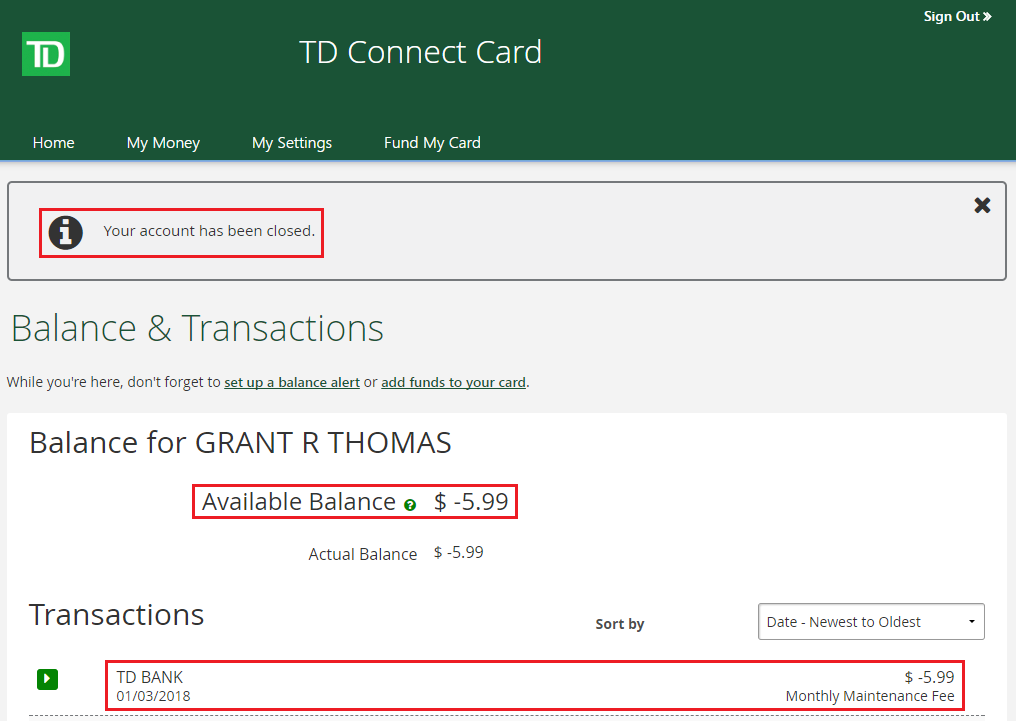

#IRSS ACCOUNT BALANE MINUS PLUS#

The employee will ultimately receive the balance in their account, which is based on contributions plus or minus investment gains or losses. These contributions generally are invested on the employee's behalf. In these plans, the employee or the employer (or both) contribute to the employee's individual account under the plan, sometimes at a set rate, such as 5 percent of earnings annually. The benefits in most traditional defined benefit plans are protected, within certain limitations, by federal insurance provided through the Pension Benefit Guaranty Corporation (PBGC).Ī defined contribution plan, on the other hand, does not promise a specific amount of benefits at retirement. Or, more commonly, it may calculate a benefit through a plan formula that considers such factors as salary and service - for example, 1 percent of average salary for the last 5 years of employment for every year of service with an employer. The plan may state this promised benefit as an exact dollar amount, such as $100 per month at retirement. The Employee Retirement Income Security Act (ERISA) covers two types of retirement plans: defined benefit plans and defined contribution plans.Ī defined benefit plan promises a specified monthly benefit at retirement.

0 kommentar(er)

0 kommentar(er)